What is interchange-plus pricing?

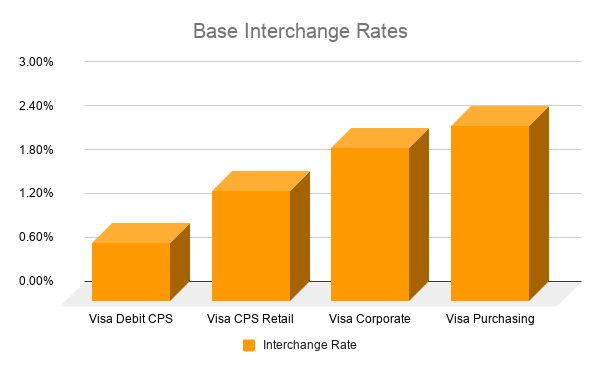

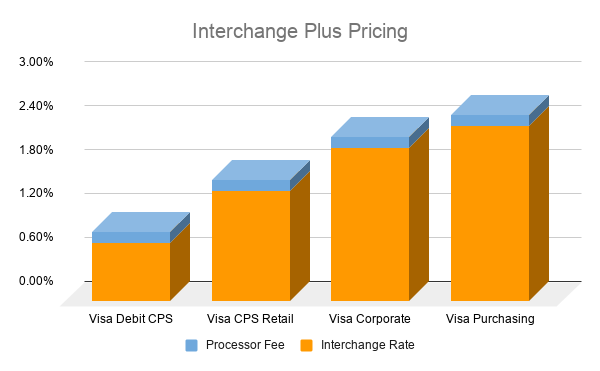

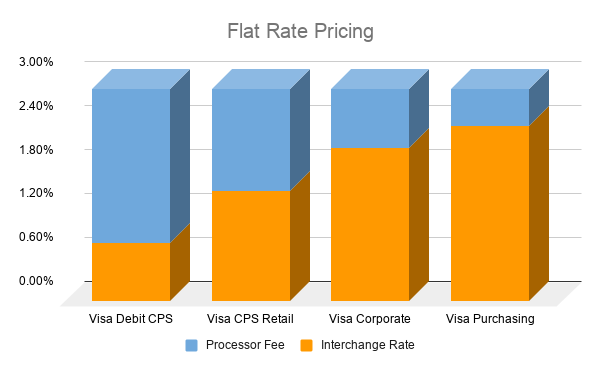

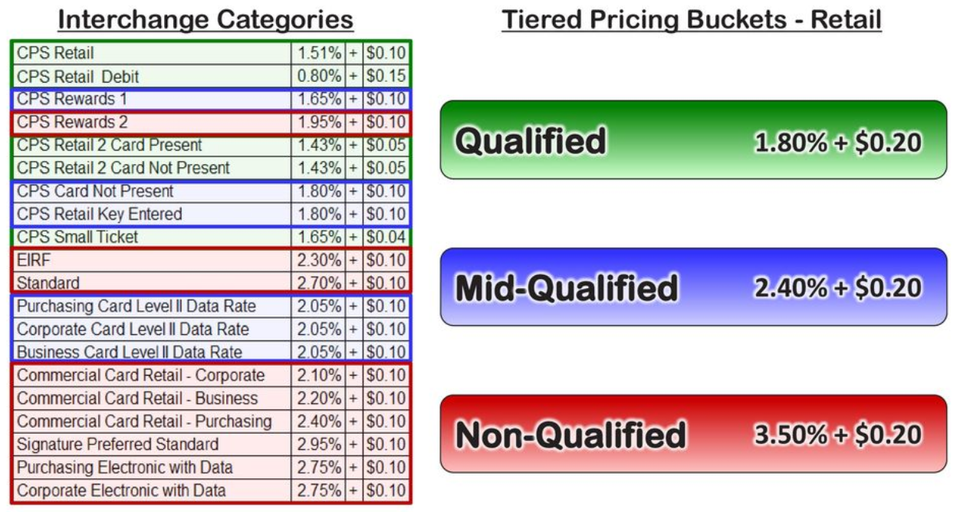

Interchange+ (also known as Cost+ pricing) is the pricing method used by Epic Financial Systems to give our merchants the lowest cost and the most transparency. Interchange are the rates charged by the card brands (Visa, MasterCard, Discover, AMEX) for use of their card. We pass the interchange costs directly on to you with an added set fee for our services (ex: 0.25% + $.10 per transaction). Example: Your customer uses a “Visa CPS Retail” credit card. The interchange rate for that card is 1.51% + $.10. We pass the interchange costs directly through to you plus our set fee of 0.25% + $.10. For this transaction, you would pay 1.76% + $.20.

Current US Interchange Rates

Visa Interchange Rates –

https://usa.visa.com/support/small-business/regulations-fees.html#1

Mastercard Interchange Rates

https://www.mastercard.us/en-us/business/overview/support/merchant-interchange-rates.html